(BigGovernment.news) Once upon a time in America job growth was driven primarily by small businesses, which also drove overall economic growth throughout the country. But increasingly, a pair of powerful, seemingly insurmountable forces besets small businesses: Big government, via the imposition of expensive rules and regulations; and big corporations, which often work hand-in-hand with big government to stifle smaller competitors.

As reported by The Daily Beast, “a host of antagonists” that include the Obama regime, large financial institutions and the ever-expanding federal bureaucracy have combined to “disempower the country’s small business community.”

In the late 19th century and early 20th century, the family farmer – “independent, hard-working, frugal and engaged in his community” – embodied the stereotypical “small business.” Eventually that characterization gave way to the Main Street business owner as the U.S. population began to gravitate away from rural areas and into towns and cities. Those earliest small business owners were typically more at odds with “oligopolistic corporations – notably utilities, oil companies and railroads – than the government,” The DB noted.

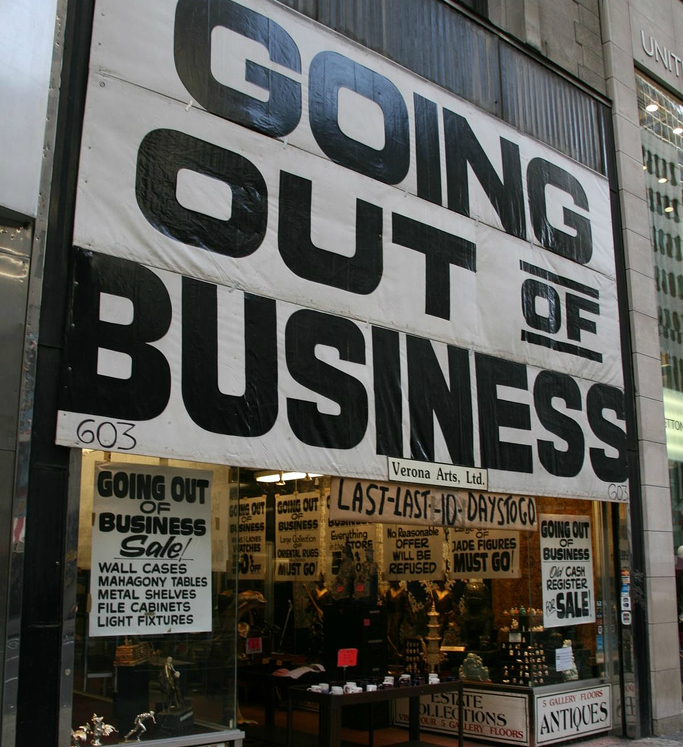

The small business community, generally defined as one with fewer than 500 employees, was on the rise during the boom years of Presidents Ronald Reagan and Bill Clinton, employing some 40 million American workers. But now it is just as clearly in decline, “with grave implications for the economy, employment, and the future of democracy,” reports The DB.

Increasingly, we live in a world where large corporations and financial institutions dominate. Real wage growth has been stagnant for the much of the middle class for decades. The Pew Research Center noted in an October 2014 report that despite rising employment, actual wage growth has not risen appreciably for most workers and for many has actually fallen over the past 50 years.

“Cash money isn’t the only way workers are compensated, of course — health insurance, retirement-account contributions, education and transit subsidies and other benefits all can be part of the package. But wages and salaries are the biggest (about 70%, according to the Bureau of Labor Statistics) and most visible component of employee compensation,” Pew reported.

Meantime, overall revenues for Fortune 500 companies have risen from 58 percent of nominal gross domestic product from 1994 to 73 percent in 2013. During the same period small business start-ups have fallen as a portion of all business growth, from 50 percent early in the Reagan 1980s to about 35 percent in 2010. And only 35 percent of small business owners now express optimism about the economy, according to a recent National Small Business Association survey cited by The DB.

This entrepreneurial decline is history. Start up rates in particular for young people have fallen dramatically and now hover at the lowest levels in 25 years. Meanwhile, the welfare state has expanded to the point where now, nearly half of all Americans get payments of some kind from the federal government (meaning taxpayers). At the same time, lack of grassroots economic activity is also likely contributing to historically low labor participation rates.

For all his talk about “leveling” playing fields, Obama’s economic policies have mostly served to enrich corporations and large financial institutes. Wall Street has enjoyed some of its biggest growth under his tenure (as has the U.S. national debt), via bank bailouts, chronically low interest rates and growing federal power.

For “the little guy,” however, such policies have done little to help. As The DB reported:

High business costs, some related to the rising tide of regulation under President Obama—including Obamacare—have become a huge burden to smaller firms. Indeed, according to a 2010 report by the Small Business Administration, federal regulations cost firms with fewer than 20 employees more than $10,000 each year per employee, while bigger firms paid roughly $7,500 per employee. The biggest hit to small business comes in the form of environmental regulations, which cost 364 percent more per employee for small firms than it does for larger ones. Small companies spend $4,101 per employee, compared to $1,294 at medium-sized companies (20 to 499 employees) and $883 at the largest companies, to meet these requirements.

Add to this unlimited (or virtually unlimited) immigration, legal and otherwise, and it’s easy to see how big government and big business has conspired to choke off small business growth to the detriment of the middle class.

Pew Research noted the same trend, reporting that what economic gains have been made have mostly gone to upper income brackets.

See also:

BigGovernment.news is part of the USA Features Media network of sites. For advertising opportunities, click here.